Essay

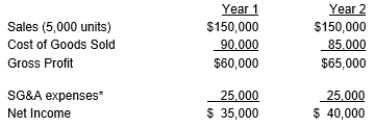

Arthur Corporation wants to change to the variable costing method of inventory valuation for making internal decisions. The LIFO method is being used. The absorption statements of income for Years 1 and 2 are as follows:

*Selling and administrative expenses include variable costs of $2 per unit sold.

*Selling and administrative expenses include variable costs of $2 per unit sold.

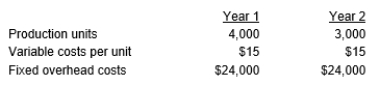

Production data are as follows:

Required:

Required:

a. Compute the absorption cost per unit manufactured in Years 1 and 2.

b. Explain why the net income for Year 1 was higher than the net income for Year 2 when the same number of units was sold in each year.

c. Prepare income statements for both years using variable costing.

d. Reconcile the absorption costing and variable costing net income figures for each year. Start with variable costing net income.

Correct Answer:

Verified

a. For Year 1, absorption costs per unit...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: Glen Oak Corp obtained the following information

Q93: Willow Company produced 15,000 units and sold

Q94: Coleman Manufacturing Company began July with 25,000

Q95: If costs are accurately estimated when establishing

Q96: For which of the following manufactured products

Q98: Under variable costing, which of the following

Q99: The Matthew Company has the following information

Q100: The following information pertains to Hamilton Corporation:<br><img

Q101: Texas Company manufactures a product through a

Q102: Which of the following inventory valuation approaches