Multiple Choice

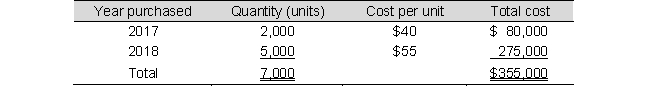

Cork Company imports and sells a product produced in Canada. In the summer of 2019, a natural disaster disrupted production, affecting its supply of product. Cork uses the LIFO inventory method. On January 1, 2019, Cork's inventory records were as follows:

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $80 per unit. Cork sold 14,200 units during 2019 at a price of $102 per unit, which significantly depleted its inventory.

Assume that Cork makes no further purchases during 2019. Compute Cork's gross profit for 2019.

A) $ 440,600

B) $1,036,600

C) $1,247,000

D) $ 485,400

Correct Answer:

Verified

Correct Answer:

Verified

Q67: Use the following inventory related information for

Q68: Bono Company reported sales of $900,000, cost

Q69: Lee Company reported the following net income

Q70: Wang Company's average inventory for 2019 was

Q71: A firm's operating figures for three successive

Q73: Use the following inventory related information for

Q74: During its first and second years of

Q75: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBCB1004/.jpg" alt=" What is

Q76: Hanover Shoes' sales totaled $8,000,000 for the

Q77: Best Buy Clothing had the following inventory