Essay

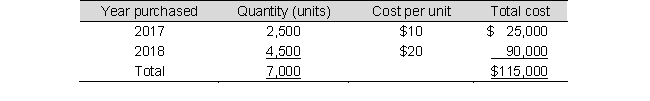

Crown Company imports and sells a product produced in Germany. In the summer of 2018, a natural disaster disrupted production, affecting its supply of product. Crown uses the LIFO inventory method. On January 1, 2019, Crown's inventory records were as follows:

Through mid-December of 2019, purchases were limited to 50,000 units, because the cost had increased to $25 per unit. Crown sold 55,000 units during 2019 at a selling price of $50 per unit, which significantly depleted its inventory. The cost was expected to drop to $21 per unit by early January, 2020.

Required:

a. Assume that Crown makes no further purchases during 2019. Compute the gross profit for 2019.

b. Assume that Crown purchases 8,800 units before the end of December, 2019 at $25 each. Compute its gross profit for 2019.

c. If Crown's corporate tax rate is 30%, how much tax savings will result from the purchase of inventory before year end?

Correct Answer:

Verified

c.

c.

*($421,000 - ...

*($421,000 - ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Use the following inventory related information for

Q42: Companies using LIFO are required to disclose

Q43: Nelson Corporation sells three different products. The

Q44: Use the following information to answer Questions

Q45: The following data represent the beginning inventory

Q47: In its 2019 income statement, Riley Company

Q48: Tisdell Fabricators, Inc., has 10 units in

Q49: Use the following inventory related information for

Q50: Assuming rising prices, which method will give

Q51: The following inventory was available for sale