Essay

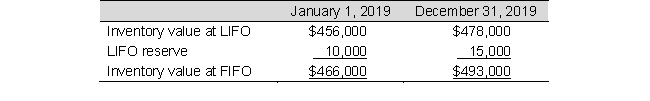

Farnsworth, Inc., reports the following information in its annual report:

Sales for 2019 totaled $4,200,000. Cost of goods sold under LIFO totaled $1,850,000. Compute Farnsworth's cost of goods sold and gross profit assuming it uses the FIFO method.

Correct Answer:

Verified

Change in LIFO reser...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: The following data refer to Billings Company's

Q33: The following data represent the beginning inventory

Q34: The lower-of-cost-or-net realizable value method may be

Q35: Which of the following inventory costing methods

Q36: The weighted-average cost method is used by

Q38: Sawyer Company reported the following net income

Q39: The following data refer to Issue Company's

Q40: The specific identification inventory costing method:<br>A) Is

Q41: Use the following inventory related information for

Q42: Companies using LIFO are required to disclose