Essay

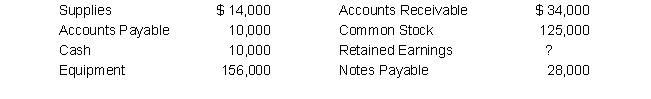

The following balance sheet information is given for Solar, Inc., at June 30, 2019:

Assume that, during the next three days, the following transactions occurred:

July 1 Paid $5,000 on accounts payable.

2 Purchased equipment for $25,000 and gave a note payable for the amount due.

3 Declared and paid a cash dividend, $4,000.

a. What was the amount of retained earnings on June 30, 2019?

b. Assume a balance sheet is prepared on July 3, 2019, after the three transactions have occurred:

(1) What amount of total assets would appear?

(2) What amount of total liabilities would appear?

(3) What amount of stockholders' equity would appear?

Correct Answer:

Verified

a. $10,000 Cash + $34,000 Accounts Recei...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Which of the following has no effect

Q2: The analysis of each transaction must result

Q3: St. Clair Motor Supplies had the

Q5: An individual record of increases and decreases

Q6: On December 31, 2018, the balance sheet

Q7: If the beginning Cash account balance was

Q8: When invoices are sent to customers billing

Q9: The chart of accounts is a tabular

Q10: The double-entry system of accounting means that:<br>A)

Q11: Match each of the numbered transactions of