Essay

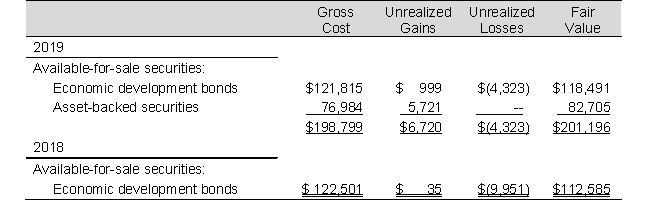

Following is a portion of the investments footnote from Urban Company's 2019 annual report.

Required

Required

a. At what amount does Urban report its available-for-sale securities on its balance sheets for 2019 and 2018?

b. How does Urban's account for its trading securities? How does the accounting differ from their accounting method for available-for-sale?

c. What are the net unrealized gains (losses) for 2019 and 2018? How did these unrealized gains (losses) affect the company's reported income in 2019 and 2018?

d. What is the difference between realized and unrealized gains and losses? Are realized gains and losses treated differently in the income statement than unrealized gains and losses for the available-for-sale securities?

Correct Answer:

Verified

a. Available-for-sale securities are rep...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Under equity method accounting, dividends paid by

Q4: A bond investment purchased at a discount:<br>A)

Q5: Crane Company purchases an investment in Windall

Q6: Golden Company purchases equity securities in Leash

Q7: In which of the following investment classifications

Q9: A corporation that controls another corporation through

Q10: If Jensen, Inc. paid $4,000 at book

Q11: Under the equity method, how are unrealized

Q12: Jarden Tech owns 30% of Stark Inc.

Q13: If investee shares are classified as "available-for-sale"