Multiple Choice

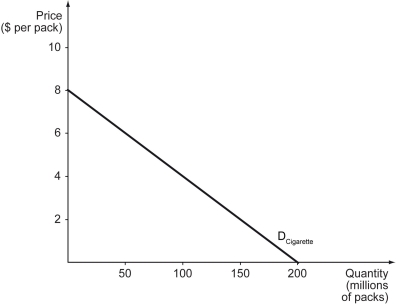

Scenario: Tobac Co. is a monopolist in the cigarette market in Nicotiana Republic, where the U.S. dollar is used as the official currency. The firm faces the demand curve shown below. The firm has a constant marginal cost of $2.00 per pack. The fixed cost of the firm is $50 million. To answer the questions below, it is useful to know that the equation of the (inverse) demand curve is P = 8 - 0.04Q, where Q is the quantity demanded (in millions of packs) and P is the price per pack (in $) . Also, you should draw in the marginal revenue curve.

-Refer to the scenario above.Tobac Co.'s total revenue is maximized when it sells ________ packs of cigarettes at ________ per pack.

A) 150 million; $2.00

B) 125 million; $3.00

C) 100 million; $4.00

D) 75 million; $5.00

Correct Answer:

Verified

Correct Answer:

Verified

Q174: Which of the following is a current

Q175: Which of the following statements is true

Q176: In Barylia,Greenaqua Corp.is the sole controller of

Q177: Everything else remaining unchanged,if a new seller

Q178: Which of the following statements is true?<br>A)

Q180: When a monopolist sells positive levels of

Q181: Which of the following statements correctly identifies

Q182: The following table shows the quantities of

Q183: The following figure is a supply-demand diagram

Q184: At a certain level of production,the marginal