Multiple Choice

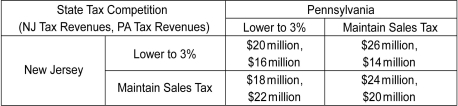

Scenario: Contiguous states often use tax policy to attract residents, firms, and economic activity. These "tax competitions" between states can be modeled with game theory. Suppose New Jersey currently has a state sales tax of 7 percent and Pennsylvania has a state sales tax of 6 percent. The game shown below models the effect of a reduction in each state's sales tax rate to 3 percent on each state's sales tax revenue. Assume the motivation of each state is to maximize tax revenue. The first number in a cell is the payoff to New Jersey; the second number is the payoff to Pennsylvania.

(Source: John Greenwald, "A No-Win War Between the States," Time, April 8, 1996, 44-45.

-Refer to the scenario above.Does New Jersey have a dominant strategy?

A) No.

B) Yes. Regardless of whether Pennsylvania decides to lower its sales tax rate, New Jersey will always gain more revenue by lowering their sales tax rate to 3 percent.

C) Yes. Regardless of whether Pennsylvania decides to lower its sales tax rate, New Jersey will always gain more revenue by maintaining their sales tax rate at 7 percent.

D) Not enough information is provided to answer the question.

Correct Answer:

Verified

Correct Answer:

Verified

Q163: A game is called a simultaneous-move game

Q164: Differentiate between a payoff matrix and a

Q165: Scenario: Your friend Joe and you decide

Q166: Scenario: The payoff matrix given below shows

Q167: The following figure depicts four simultaneous-move games.

Q169: Scenario: Two rival firms are considering sponsoring

Q170: Suppose two outdoor apparel firms,L.L.Bean and Eddie

Q171: Scenario: The following table represents the game

Q172: Scenario: Consider the tragedy of the commons

Q173: Scenario: Miguel and Stephanie are competitors who