Multiple Choice

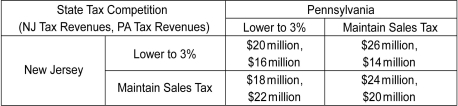

Scenario: Contiguous states often use tax policy to attract residents, firms, and economic activity. These "tax competitions" between states can be modeled with game theory. Suppose New Jersey currently has a state sales tax of 7 percent and Pennsylvania has a state sales tax of 6 percent. The game shown below models the effect of a reduction in each state's sales tax rate to 3 percent on each state's sales tax revenue. Assume the motivation of each state is to maximize tax revenue. The first number in a cell is the payoff to New Jersey; the second number is the payoff to Pennsylvania.

(Source: John Greenwald, "A No-Win War Between the States," Time, April 8, 1996, 44-45.

-Refer to the scenario above.Is there a set of payoffs that is superior to the payoffs realized at the dominant strategy equilibrium?

A) No.

B) Yes, New Jersey maintains its sales tax rate, realizing $18 million in tax revenues, and Pennsylvania lowers its sales tax rate, realizing $22 million in tax revenues.

C) Yes, New Jersey maintains its sales tax rate, realizing $24 million in tax revenues, and Pennsylvania also maintains its sales tax rate, realizing $20 million in tax revenues.

D) Yes, New Jersey lowers its sales tax rate, realizing $26 million in tax revenues, and Pennsylvania maintains its sales tax rate, realizing $14 million in tax revenues.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The following figure depicts four simultaneous-move games.

Q2: Scenario: The payoff matrix given below shows

Q3: Scenario: Vladimir and Alphonso are collectors

Q4: Which of the following is true of

Q5: Scenario: The payoff matrix given below shows

Q7: Scenario: Miguel and Stephanie are competitors who

Q8: Scenario: Consider the tragedy of the commons

Q9: Scenario: Rita and Mike have been caught

Q10: Scenario: The following payoff matrix represents a

Q11: Scenario: Two rival firms charge equal prices