Multiple Choice

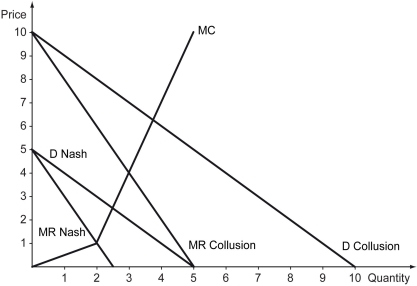

Scenario: There are two firms in an industry, Firm A and Firm B, and they consider entering into a colluding agreement. If the two firms collude, then they agree that they would both produce less than what they would if they were competing against each other in an oligopolistic market. Since Firm A expects Firm B to produce a small quantity of output in the colloding agreement, Firm A is facing a demand curve with the same slope but with a higher intercept. The following figure depicts demands that face Firm A in both the colluding agreement and the oligopolistic market.

-Refer to the figure above.What is the profit that Firm A can get by cheating on the collusive agreement?

A) $4

B) $8.50

C) $9

D) $21

Correct Answer:

Verified

Correct Answer:

Verified

Q100: A wholesale flower market is an example

Q101: Scenario: The fixed cost of producing 500

Q102: Which of the following is true?<br>A) In

Q103: The floral industry in Rose Valley has

Q104: La Dila and Swiss Pro are the

Q106: Scenario: The fixed cost of producing 500

Q107: Long-run equilibrium in a monopolistically competitive industry

Q108: Scenario: There are several pen manufacturers in

Q109: The table below summarizes the information possessed

Q110: The marginal revenue curve of a monopolistic