Essay

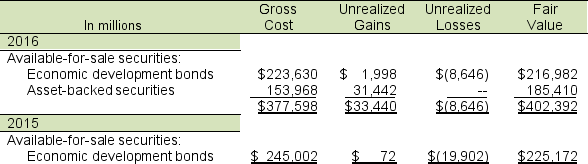

Following is a portion of the investments footnote from Athletic Supply's 2016 annual report.

A. At what amount does Athletic Supply report its available-for-sale securities on its balance sheets for 2016 and 2015?

A. At what amount does Athletic Supply report its available-for-sale securities on its balance sheets for 2016 and 2015?

B. How does Athletic Supply account for its trading securities? How does the accounting differ from their accounting method for available-for-sale?

C. What are the net unrealized gains (losses) for 2016 and 2015? How did these unrealized gains (losses) affect the company's reported income in 2016 and 2015?

D. What is the difference between realized and unrealized gains and losses? Are realized gains and losses treated differently in the income statement than unrealized gains and losses for the available-for-sale securities?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: When the fair value of a company's

Q3: GAAP identifies three levels of influence/control. Which

Q4: An investor company can be considered to

Q5: Financial statements of investee and investor companies

Q6: When a passive investment is sold, the

Q7: Following is a portion of the investments

Q8: Which will be accounted for differently from

Q9: Consider companies with the pre-acquisition balance sheets

Q10: Companies are required to disclose both qualitative

Q11: The following is from footnotes from the