Essay

Vast Horizons has 20,000 outstanding shares of common stock with par value of $1.50 per share and market price on January 1 of $30.

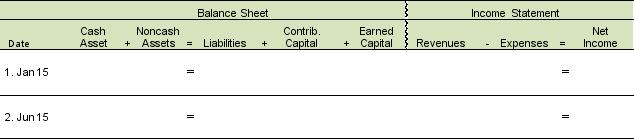

A. Show the financial statement effects of the two independent equity transactions in the template below.

1. January 15: 6% stock dividend paid to common shareholders with current market price at $30

2. June 15: 28% stock dividend paid to common shareholders with current market price at $80

B. How have these two transactions changed the overall valuation of the firm?

B. How have these two transactions changed the overall valuation of the firm?

Correct Answer:

Verified

A.

1. Common stock = 20,000 shares × 6...

1. Common stock = 20,000 shares × 6...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: Identify the benefits received from being a

Q31: Which is not an item that should

Q32: Friendly Company has 20,000 shares of $160

Q33: One reason a company may repurchase stock

Q34: Sea Bird Co. announces a large stock

Q36: All conversion options for convertible securities are

Q37: Clockworks Company began business on January 1

Q38: For small stock dividends, by what amount

Q39: Stockholders' equity represents the current market value

Q40: Use the following consolidated statement of stockholders'