Essay

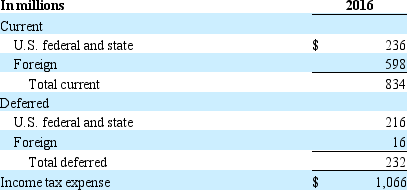

The income tax footnote to the financial statements of Cucumber, Inc. for the year ending December 31, 2016 is as follows.

A. How much income tax expense is reported in Cucumber, Inc.'s income statement for 2016?

A. How much income tax expense is reported in Cucumber, Inc.'s income statement for 2016?

B. How much of the income tax expense is payable in cash in 2016?

C. Provide an example to explain how the deferred tax expenses could be positive in 2016?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Rosebud Corp. reported the following items in

Q2: The following is the leasing commitment information

Q4: The following is an excerpt from the

Q5: Rosebud Corp. reported the following items in

Q6: M. A. Ivy Company reports the following

Q7: Use the following information to answer questions

Q8: What are deferred taxes? When do they

Q9: Which one of the following statements is

Q10: With respect to estimate changes in pension

Q11: Failure to capitalize leases has very little