Essay

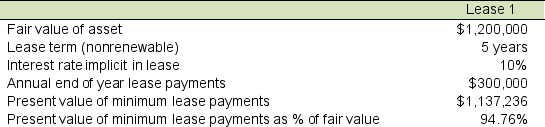

DuPage Company is interested in leasing a machine and has identified the following possible lease that it may acquire.

Prior to making this decision and without the lease information, DuPage Company has the following amounts:

Prior to making this decision and without the lease information, DuPage Company has the following amounts:

●Assets: $5,500,000

●Liabilities: $4,500,000

●Income before lease expenses: $750,000

●Income tax rate 35%

Prepare an independent analysis for the lease that includes the assets and liabilities sections of the balance sheet and an income statement, as well as a comparison of debt-to-equity ratios and return on asset ratios. Assume equity is $1,000,000 before considering the leases and $958,829 when considering the leases. Briefly summarize the effect on the two ratios.

Correct Answer:

Verified

Lease payment interest = $1,137,236 × 10...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: With respect to estimate changes in pension

Q11: Failure to capitalize leases has very little

Q12: Failure to recognize leases as capital leases

Q13: The following pension information was disclosed by

Q14: Both IFRS and U.S. GAAP require companies

Q16: Use the following information to answer questions

Q17: Operating leases appear as assets on the

Q18: Which of the following is a significant

Q19: Which of the following is not a

Q20: The defined contribution plan and the defined