Essay

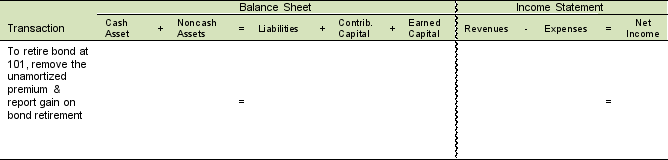

Power 2020 Company issued $1,400,000 of 7%, 20-year bonds at 104 on January 1, 2002. Interest is payable semi-annually on July 1 and January 1. Through January 1, 2016, Power 2020 amortized $39,200 of the bond premium. On January 1, 2016, Power 2020 retires the bond at 101 (after making the interest payment on that date). Using the following table, indicate the effects on the company's financial statements of the bond retirement for January 1, 2016.

Correct Answer:

Verified

$1,400,000 × 1.04 = $1,456,000 issue pr...

$1,400,000 × 1.04 = $1,456,000 issue pr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Determine how each of the following transactions

Q2: The price of a bond is equivalent

Q3: Debt ratings specify the amount at which

Q4: Select the following items with each of

Q5: Select the following items with each of

Q7: A bond selling for an amount above

Q8: The following data relates to Beluga Company

Q9: What effects would the accrual of $200

Q10: The following table lists some bond rankings:<br>

Q11: How many payment periods are in a