Essay

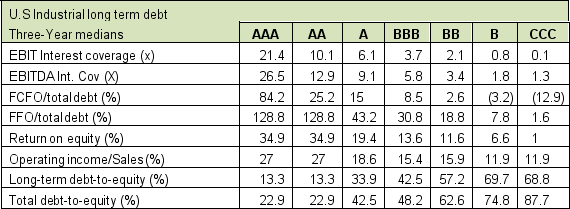

You are a pension fund manager looking for an investment vehicle that will provide your fund with a reliable stream of income over the next 10 years. You want to find the best yield possible while still conforming to the pension fund covenant of investing in investment grade bonds or better. You are trying to decide between the following investment options for your equity:

A. Diner by the Sea

10 years, 5.5% yield, EBIT Interest coverage ratio = 4.0, EBITDA Interest coverage ratio = 6.0, total debt of $480,000,000 (all of which is long term), total equity of $1,000,000,000, and a return on equity of 8.3

B. Perfect Home Products

10 years, 2.5% yield, EBIT Interest coverage ratio = 22.0, EBITDA Interest coverage ratio = 31.0, total debt of $320,000,000 (all of which is long term), total equity of $10,000,000,000, and a return on equity of 25.0

C. Cell Phone Supplies, Inc.

10 years, 8.5% yield, EBIT Interest coverage ratio = 0.78, EBITDA Interest coverage ratio = 1.3, total debt of $210,000,000, total equity of $320,000,000, and a return on equity of 8.2

Using the table below, discuss each investment option's pros and cons, attempt to determine the grade of each bond, and ultimately make an argument for which bond is the appropriate investment for your pension fund. Note: Bonds rated BB, or lower, are considered to be non-investment grade bonds.

Correct Answer:

Verified

A. Diner by the Sea: Diner by the Sea's ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: Companies with current maturities of long-term debt

Q33: Following are the liability and equity sections

Q34: Which of the following details of a

Q35: The bond issuing company can repurchase its

Q36: Select the following items with each of

Q38: Security for debt in the form of

Q39: Select the following items with each of

Q40: If Mary's Motor Parts issues $2,300,000 in

Q41: Which of the following is true concerning

Q42: Market prices of bonds fluctuate because the