Essay

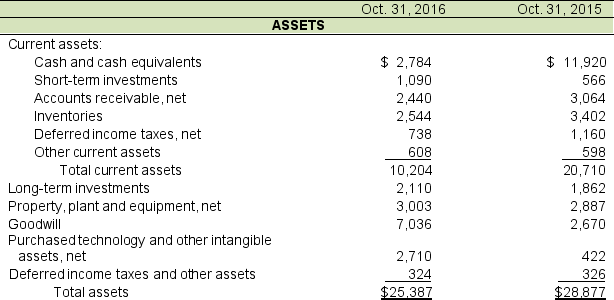

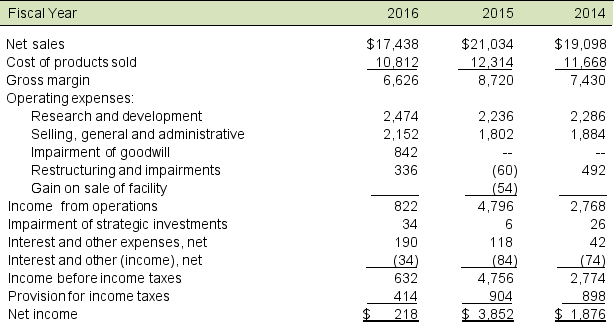

Marvelous Materials presented the following partial balance sheet, income statements, and note disclosure for its fiscal years ending in 2016 and 2015. All amounts are in millions.

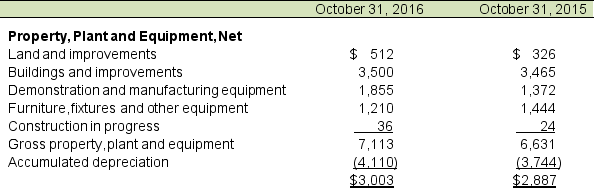

The following appeared in Note 7 of the company's annual report:

The following appeared in Note 7 of the company's annual report:

Property, Plant and Equipment

Property, plant and equipment are stated at cost. Depreciation is provided over the estimated useful lives of the assets using the straight-line method. Estimated useful lives for financial reporting purposes are as follows: buildings and improvements, 3 to 30 years; demonstration and manufacturing equipment, 3 to 5 years; software, 3 to 5 years; and furniture, fixtures and other equipment, 3 to 15 years. Land improvements are amortized over the shorter of 15 years or the estimated useful life. Leasehold improvements are amortized over the shorter of five years or the lease term.

Analyze and interpret Marvelous Materials' plant assets and the company's related ratios and disclosures by answering the questions that follow:

Analyze and interpret Marvelous Materials' plant assets and the company's related ratios and disclosures by answering the questions that follow:

A. Compute PPE turnover for 2016 and 2015 if net plant assets for 2014 are $3,197 in millions. Interpret and explain any change in turnover.

B. What long-term assets might not be reflected on its balance sheet?

C. Estimated depreciation expense is $510 (in millions) for 2016. Compute the percent depreciated for 2016. What implication does the used up computation have for future cash flows?

Correct Answer:

Verified

A. 2016: Net sales / Average PP&E, net =...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: Impairment of long-term plant assets is determined

Q34: Asset write-downs have two potential challenges. One

Q35: An estimate of how an asset will

Q36: Following are selected financial information from Foster

Q37: The following information is reported for the

Q39: Entire Foods Market, Inc. provides the following

Q40: Under IFRS, research and development costs can

Q41: Depreciation is the recognition of the change

Q42: For each of the following items, indicate

Q43: Under which section of a statement of