Essay

Following is financial information (millions) from Tractor & Company's two segments as of October 31, 2016:

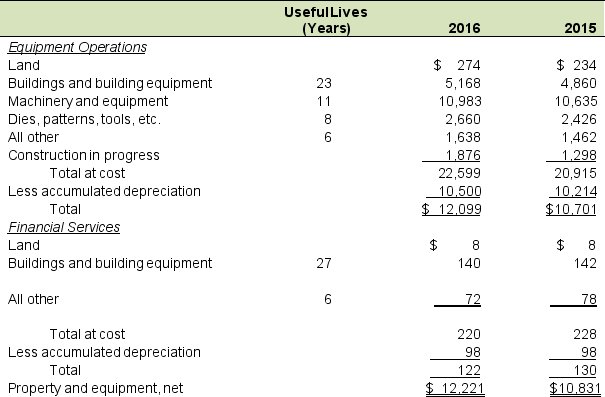

A summary of property and equipment at October 31 in millions of dollars follows:

Tractor & Company uses straight-line depreciation. Depreciation expense for 2016 is $1,110.

Tractor & Company uses straight-line depreciation. Depreciation expense for 2016 is $1,110.

A. Compute PPE turnover for 2016 and 2015. PPE net for 2014 is $9,478 million. Analyze your findings. Sales for 2016 are $83,753 million and are $73,665 million for 2015.

B. By what percentage are Tractor's depreciable assets depreciated at the end of 2016? Analyze your computations.

Correct Answer:

Verified

A. PPE asset turnover = Sales / Average ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Which of the following is not part

Q23: Green Garden Company purchased a tractor at

Q24: Companies that have property, plant, and equipment

Q25: Explain the considerations a CFO would make

Q26: Leaping Deer Company purchased a tractor at

Q28: Leaping Deer Company purchased a tractor at

Q29: Major Carmaker Co. plans to build a

Q30: An analyst should consider any goodwill write-downs

Q31: Changes in accounting estimates affect only the

Q32: Leaping Deer Company purchased a tractor at