Essay

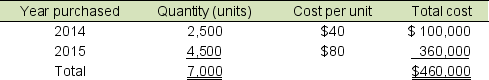

Hannibal Company imports and sells a product produced in Germany. In the summer of 2015, a natural disaster disrupted production, affecting its supply of product. Hannibal uses the LIFO inventory method. On January 1, 2016, Hannibal's inventory records were as follows:

Through mid-December of 2016, purchases were limited to 50,000 units, because the cost had increased to $100 per unit. Hannibal sold 55,000 units during 2016, at a selling price of $200 per unit, which significantly depleted its inventory. The cost was expected to drop to $84 per unit by early January, 2017.

Through mid-December of 2016, purchases were limited to 50,000 units, because the cost had increased to $100 per unit. Hannibal sold 55,000 units during 2016, at a selling price of $200 per unit, which significantly depleted its inventory. The cost was expected to drop to $84 per unit by early January, 2017.

A. Assume that Hannibal makes no further purchases during 2016. Compute the gross profit for 2016.

B. Assume that Hannibal purchases 8,800 units before the end of December, 2016 at $100 each. Compute its gross profit for 2016.

C. If Hannibal's corporate tax rate is 30%, how much tax savings will result from the purchase of inventory before year end?

Correct Answer:

Verified

Correct Answer:

Verified

Q28: The average cost inventory costing method is

Q29: The following amounts and costs of platters

Q30: When using the LIFO inventory method in

Q31: Trusted Tires has the following inventory records

Q32: Anka Company uses the LIFO inventory costing

Q34: Which of the following is not a

Q35: Which of the following is an inventory

Q36: When making investment decisions, why is it

Q37: On which financial statement would you look

Q38: Selected balance sheet and income statement information