Essay

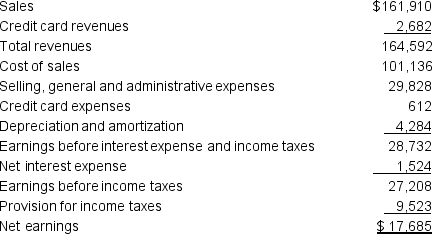

Bullseye, Inc. is a large retailer. Its income statement for the year ending January 30, 2016 (in millions) follows:

Selected amounts from Bullseye's 2016 and 2015 balance sheets follow (amounts in millions):

Selected amounts from Bullseye's 2016 and 2015 balance sheets follow (amounts in millions):

Assume a marginal tax rate of 35%.

Assume a marginal tax rate of 35%.

Determine the following for Bullseye for its year ending January 30, 2016:

A. NOPAT

B. RNOA

C. NOPM (Use total revenues for this calculation)

D. Interpret the meaning of these three amounts as it applies to Bullseye.

Correct Answer:

Verified

A. NOPAT = Net income ‒ [(Nonoperating r...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: Gray Tabby, Inc. provided the following aging

Q33: The net accounts receivable reported in the

Q34: Caroline's Collectibles estimates its uncollectible accounts by

Q35: Omni Corporation describes its revenue recognition policies

Q36: At December 31, 2016, retailer Susan Bicycles

Q38: American Chocolate Co. reports the following in

Q39: Revenues from discontinued operations of a company

Q40: Identify and explain when each of the

Q41: Income statement effects of uncollectibles occur at

Q42: Andy's accounts receivable financial data (in millions)