Essay

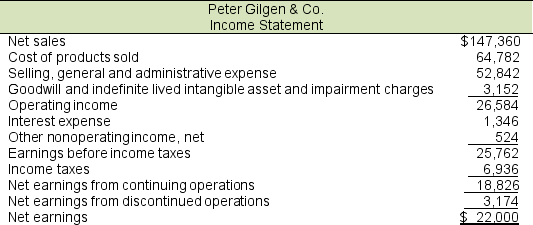

Peter Gilgen & Co.'s (PG & Co.) recent balance sheet (fiscal year 2016) reported average equity of $112,036 and average total assets of $240,598. Assume that the company's statutory tax rate is 35%. PG & Co.'s recent income statement showed the following):

A. Calculate the income tax rate on earnings before income taxes.

A. Calculate the income tax rate on earnings before income taxes.

B. How much is EWI?

C. Calculate ROE and ROA.

Correct Answer:

Verified

A. Tax rate on income from continuing op...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Selected 2016 balance sheet and income statement

Q24: When determining forecasted revenues for proforma purposes,

Q25: Asset turnover measures a company's profitability.

Q26: K Grocers' 2016 financial statements show total

Q27: All else being equal, a higher financial

Q29: Use the following selected balance sheet and

Q30: Which one of the following is not

Q31: Selected 2016 balance sheet and income statement

Q32: If Company A is more profitable than

Q33: The balance sheets for Bullseye Corporation for