Essay

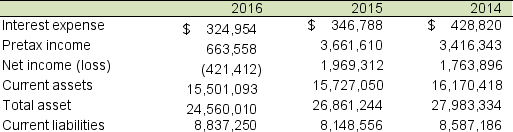

Selected balance sheet and income statement information for the office supply retailer, Office Supply, Inc., for FY 2014 through FY 2016 follows:

A. Compute the current ratio for each year and discuss any trends. Do you feel that the company is sufficiently liquid? Explain. What additional information might be helpful in analyzing the liquidity?

A. Compute the current ratio for each year and discuss any trends. Do you feel that the company is sufficiently liquid? Explain. What additional information might be helpful in analyzing the liquidity?

B. Compute times interest earned ratio for each year and discuss any trends. Do you have any concerns about its level of financial leverage and its ability to meet interest obligations? Explain.

Correct Answer:

Verified

A. 2016: $15,501,093 / $8,837,250 = 1.75...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: K Grocers' 2016 financial statements show average

Q6: Selected 2016 balance sheet and income statement

Q7: Selected balance sheet and income statement information

Q8: The income statements for Bullseye Corporation for

Q9: Selected 2016 balance sheet and income statement

Q11: Selected balance sheet and income statement information

Q12: Use the selected balance sheet and income

Q13: The balance sheets and income statements for

Q14: NOPAT is equivalent to income from operating

Q15: Selected recent balance sheet and income statement