Essay

The income statements for Bullseye Corporation for fiscal years 2015, 2014, and 2013 follow:

Prepare a pro-forma income statement for 2016 for Bullseye assuming the following:

Prepare a pro-forma income statement for 2016 for Bullseye assuming the following:

A. Total revenues are $142,000 million.

B. Cost of sales is 68% of net sales.

C. Selling, general and administrative expenses increase by 10% from 2015. Credit card expense increases by 12%.

D. Depreciation increases by 5%

E. There is no gain on receivables held for sale.

F. Interest costs remain the same.

G. The effective income tax rate is 35%.

Correct Answer:

Verified

Correct Answer:

Verified

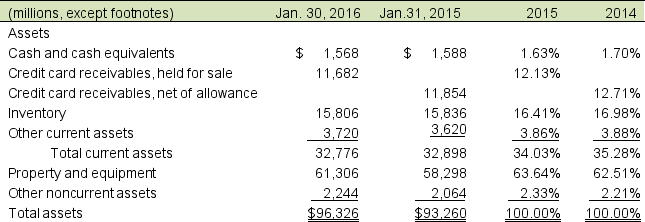

Q41: Use the selected balance sheet and income

Q42: What does the current ratio measure?<br>A) Solvency<br>B)

Q43: Charlie Plumbing Supplies has a return on

Q44: Use the following selected balance sheet and

Q45: K Grocers' 2016 financial statements show net

Q47: Selected recent balance sheet and income statement

Q48: Highly leveraged firms have higher ROE than

Q49: Return on assets can be disaggregated into

Q50: Explain the trade-off between profit margin and

Q51: Ratio analysis is more complicated when a