Essay

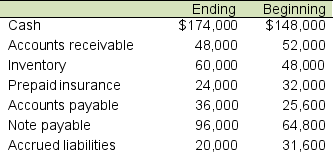

Little Kerry Inc. had a $64,000 net loss from operations in 2016. Depreciation expense for 2016 was $126,400 and a 2016 cash dividend of $144,000 was declared and paid. Balances of the current asset and current liability accounts at the beginning and end of 2016 follow.

Did Little Kerry's 2016 operating activities provide or use cash and by what amount? Use the indirect method to determine your answer and show your work.

Did Little Kerry's 2016 operating activities provide or use cash and by what amount? Use the indirect method to determine your answer and show your work.

Correct Answer:

Verified

Little Kerry, Inc.'...

Little Kerry, Inc.'...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The following amounts have been taken from

Q2: Becky Company uses the indirect method. Selected

Q3: Construction Hats purchased equipment for $248,000 cash,

Q4: In which of the three activity categories

Q5: In which of the three activity categories

Q7: A company reported annual income tax expense

Q8: You took a job as the new

Q9: If accounts payable increase during an accounting

Q10: The following amounts have been taken from

Q11: The following information relates to Kailey Company