Essay

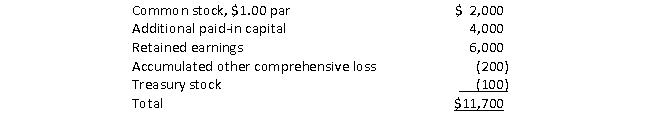

Prism Corporation acquires the voting stock of Streetspace Inc. on January 1, 2020, for $100,000 in cash. Streetspace's book value at the date of acquisition was:

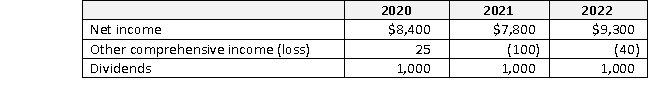

All of Streetspace's recorded assets and liabilities are carried at fair value, but it has previously unrecorded customer-related intangible assets valued at $28,000 that are capitalizable under the requirements of ASC Topic 805. These intangibles have an estimated life of 5 years, straight-line. It is determined through impairment testing that acquired goodwill is impaired by $500 in 2020, and is unimpaired in 2021 and 2022. Customer-related intangible assets are not impaired during the three years following acquisition. Streetspace reports net income, other comprehensive income, and declared and paid dividends as follows for 2020, 2021, and 2022:

All of Streetspace's recorded assets and liabilities are carried at fair value, but it has previously unrecorded customer-related intangible assets valued at $28,000 that are capitalizable under the requirements of ASC Topic 805. These intangibles have an estimated life of 5 years, straight-line. It is determined through impairment testing that acquired goodwill is impaired by $500 in 2020, and is unimpaired in 2021 and 2022. Customer-related intangible assets are not impaired during the three years following acquisition. Streetspace reports net income, other comprehensive income, and declared and paid dividends as follows for 2020, 2021, and 2022:

Prism uses the complete equity method to account for its investment in Streetspace on its own books.

Prism uses the complete equity method to account for its investment in Streetspace on its own books.

Required

a. Calculate the amount Prism reports for 2022 as equity in net income of Streetspace on its own books.

b. Present, in journal entry form, the four eliminating entries needed to consolidate the trial balances of Prism and Streetspace at December 31, 2022. Revaluation write-offs are adjustments to operating expenses.

Correct Answer:

Verified

None...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: Princeton Corporation acquired the voting stock of

Q51: Playlink Corporation acquired the voting stock

Q52: Which statement is true concerning U.S. GAAP

Q53: When consolidating the accounts of a parent

Q54: A parent acquires its subsidiary on January

Q56: Assume a U.S. company decides to quantitatively

Q57: How does the complete equity method, used

Q58: Which statement is false concerning IFRS for

Q59: The major justification for adding a qualitative

Q60: A wholly-owned subsidiary reports income of $5