Essay

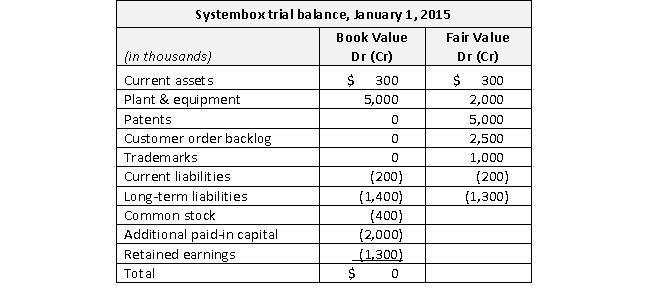

Pyroplex Corporation acquires the voting stock of Systembox Co. on January 1, 2015 at an acquisition cost of $15,300. Systembox's trial balance at the date of acquisition is as follows, along with fair value information for its identifiable net assets:

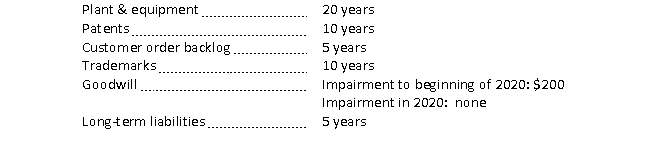

Goodwill connected with this acquisition is $6,000. As of January 1, 2015, the revaluations have the following estimated lives (all straight-line):

Goodwill connected with this acquisition is $6,000. As of January 1, 2015, the revaluations have the following estimated lives (all straight-line):

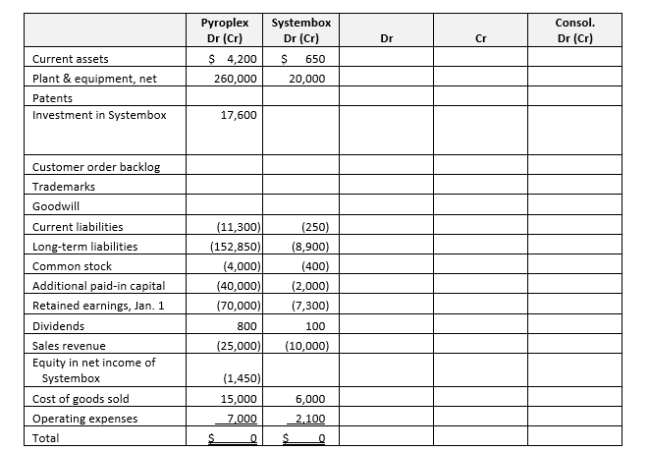

Pyroplex uses the complete equity method to account for its investment in Systembox on its own books. The December 31, 2020 trial balances for Pyroplex and Systembox (six years after acquisition) appear in the consolidation working paper provided.

Pyroplex uses the complete equity method to account for its investment in Systembox on its own books. The December 31, 2020 trial balances for Pyroplex and Systembox (six years after acquisition) appear in the consolidation working paper provided.

Required

Required

a. Fill in the consolidation working paper as necessary to consolidate the trial balances of Pyroplex and Systembox at December 31, 2020.

b. Present the 2020 consolidated income statement and the December 31, 2020 consolidated balance sheet, in good form.

Correct Answer:

Verified

Correct Answer:

Verified

Q95: Pointer Company acquired the voting common

Q96: A wholly-owned subsidiary's plant assets have a

Q97: If the parent company uses the complete

Q98: Consolidated retained earnings at the end of

Q99: Use the following information to answer

Q101: Mojo Corporation acquires all the voting stock

Q102: An acquisition requires revaluation of a subsidiary's

Q103: Which statement is true concerning impairment testing

Q104: Use the following information to answer

Q105: Use the following information to answer