Multiple Choice

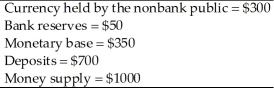

Consider an economy that has the following monetary data.

The monetary base and the money supply are expected to grow at a constant rate of 20% per year.Inflation and expected inflation are 20% per year.Suppose that bank reserves and currency pay no interest,all currency is held by the public,and bank deposits pay no interest.What is the cost to the public of the inflation tax?

A) $60

B) $140

C) $190

D) $200

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which of the following policies would not

Q7: A Social Security system in which payroll

Q8: When the United States engaged in quantitative

Q9: Recent proposals to allow the Social Security

Q10: From 2001 to 2015,the debt-GDP ratio in

Q12: The graph plotting the tax rate on

Q13: At the beginning of year one,there is

Q14: From the late 1960s to the late

Q15: Government capital consists of<br>A)money owned by the

Q16: When did the United States suffer hyperinflation?<br>A)Revolutionary