Essay

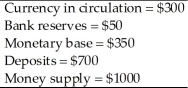

Consider an economy that has the following monetary data.

The monetary base and the money supply are expected to grow at a constant rate of 20% per year.Inflation and expected inflation are 20% per year.Suppose that bank reserves and currency pay no interest,all currency is held by the public,and bank deposits pay no interest.

(a)What is the cost to the public of the inflation tax?

(b)What is the nominal value of seignorage over the year?

(c)What is the profit to the banks from the inflation?

Correct Answer:

Verified

(a)$200

(b...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(b...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q69: Why is the Social Security system in

Q70: The primary deficit is equal to<br>A)the amount

Q71: The total value of government bonds outstanding

Q72: An increase in the marginal tax rate,with

Q73: You are given the following budget data

Q75: Whether real seignorage revenue increases when the

Q76: When the United States engaged in quantitative

Q77: Interest payments by the government as a

Q78: The inflation tax is primarily a tax

Q79: Real money demand in the economy is