Multiple Choice

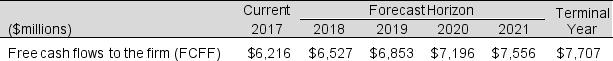

Assume the following free cash flows for Aiello Inc. for 2016 and forecasted FCFF for 2017 onward (in millions) : The DCF value of the firm using the FCFF information above, a discount rate of 6%, and an expected terminal growth rate of 2%, is:

The DCF value of the firm using the FCFF information above, a discount rate of 6%, and an expected terminal growth rate of 2%, is:

A) $176,900 million

B) $126,028 million

C) $145,189 million

D) $181,836 million

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following descriptions of the

Q10: In its 2017 fiscal year report, a

Q11: Alpine Corporation reported the following information for

Q12: The residual operating income (ROPI) model estimates

Q13: Which of the following is incorrect (r<sub>w</sub>

Q15: Following is financial information for Washington Corporation

Q16: All of the following are attributes of

Q17: Given the following information, calculate the ROPI

Q18: Discuss why NOPAT is used in calculating

Q19: Konerko Corporation has a forecasted free cash