Short Answer

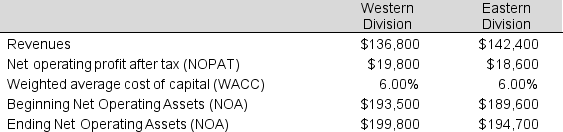

Suppose you are an officer for Innovative Components, Inc. and are presented with the following information regarding your two operating divisions:

Required:

Required:

a. Compute the residual operating income (ROPI) for each division.

b. Compare the residual operating income (ROPI) for each division. Which division is performing better?

c. What would you recommend to each division's top manager to improve its performance?

Correct Answer:

Verified

a.

b. Although the Western Division ge...

b. Although the Western Division ge...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q73: Two public companies (Jensen and Jackson) operate

Q74: A company can increase free cash flows

Q75: Following are financial statement numbers and select

Q76: Which of the following items is an

Q77: What is "Weighted Average Cost of Capital"

Q79: The higher the expected growth rate of

Q80: Consider a management team that has its

Q81: Differing accrual accounting policies have an impact

Q82: A firm has expected residual operating income

Q83: There is no difference between valuing debt