Short Answer

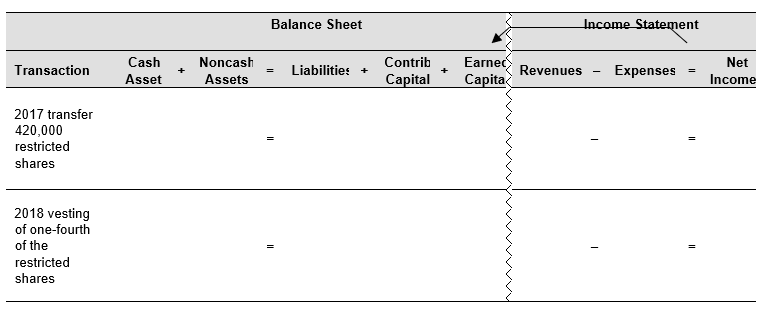

Salem, Inc. implemented a restricted stock plan in early 2017. The company transferred 420,000, $1 par shares to the restricted stock plan, that day the stock was trading at $24.83. The restricted shares vest over four years.

Use the financial statement effects template below to record the transfer of the shares in 2017 and the vesting in 2018

Correct Answer:

Verified

Correct Answer:

Verified

Q58: The following information is from 2016 statement

Q59: What is a stock split? Why do

Q60: The following is a summary of the

Q61: Discuss the impact of stock issuance and

Q62: Cisco Systems Inc. reported the following in

Q64: Retained earnings and accumulated other comprehensive income

Q65: Which of the following is not a

Q66: As a shareholder of General Mills, how

Q67: Oil Services Corp. reports the following EPS

Q68: Buffalo Co. compensates its executives with restricted