Short Answer

Miller Corp. reported the following in its 2016 10K report:

In September 2012, the Company sold $330,000,000 of its 4.75% variable interest senior convertible debentures due 2032 in a private offering to qualified institutional buyers in accordance with Rule 144A under the Securities Act of 1933…The debentures are convertible into the Company's common stock at the holder's option. The conversion price at December 31, 2016 was $32.00 per share (31.25 shares of common stock per $1,000 principal amount of the note), is subject to adjustment for various events, including the issuance of stock dividends.

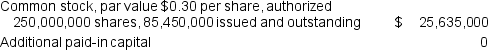

The company's December 31, 2016, balance sheet reports the following:

If all of the convertible debentures were converted to common stock on January 1, 2017, what would the common stock and additional paid-in capital account totals be?

If all of the convertible debentures were converted to common stock on January 1, 2017, what would the common stock and additional paid-in capital account totals be?

Correct Answer:

Verified

The debentures total $330,000,000. At a ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Josette Dupress, a sagacious investor, prefers the

Q3: A company with outstanding in-the money employee

Q4: A company is worse off by paying

Q5: On September 20, 2017, Umatilla Company announced

Q6: Riverton, Inc. declares a small stock dividend

Q8: Oil Services Corp. reports the following EPS

Q9: A stock split is a monetary transaction.

Q10: The SEC requires that firms report both

Q11: What are some of the benefits received

Q12: Thermopolis, Inc. reported retained earnings of $490,953