Short Answer

The 2016 Form 10-K of NetFlix includes the following footnoted information. Use this information to answer the required.

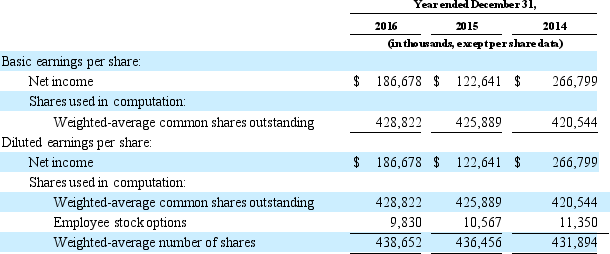

The computation of net income per share is as follows:

Employee stock options with exercise prices greater than the average market price of the common stock were excluded from the diluted calculation as their inclusion would have been anti-dilutive.

Employee stock options with exercise prices greater than the average market price of the common stock were excluded from the diluted calculation as their inclusion would have been anti-dilutive.

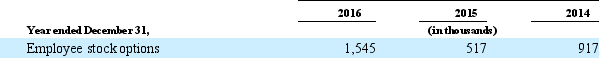

The following table summarizes the potential common shares excluded from the diluted calculation (in thousands):

Required:

Required:

a. What are the potential sources of dilution of NetFlix's earnings per share?

b. List two additional dilutive securities (other than those NetFlix includes).

c. NetFlix did not include all outstanding employee stock options in the calculation of diluted net income per share in 2016? Why not? How many options were excluded?

d. Calculate basic EPS for each of the three years.

e. Calculate diluted EPS for each of the three years.

Correct Answer:

Verified

a. NetFlix has granted employee stock op...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: DuBois, Inc. announces a large stock dividend

Q36: All of the following are potentially dilutive

Q37: Chemult Company reported the following transactions on

Q38: Below are excerpts from the 2016 Alleghany

Q39: The 2016 Form 10-K of Pacific Gas

Q41: If Home Depot loses its dominance in

Q42: On April 15, 2017, Maryhill, Inc. has

Q43: Following is the stockholders' equity section of

Q44: When stock options are granted, the contributed

Q45: Explain the accounting treatment difference between a