Short Answer

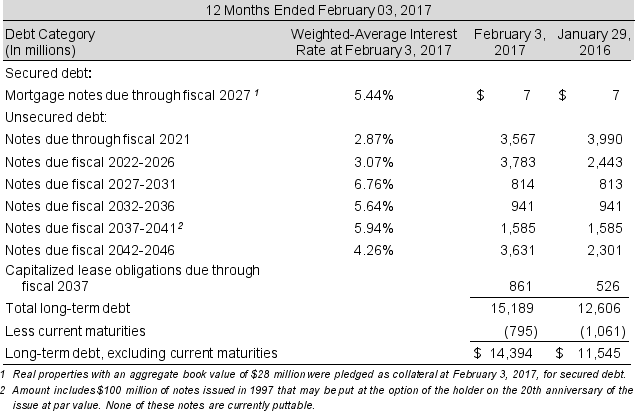

Following is the debt footnote from the Lowe's 2017 form 10-K:

Required:

Required:

a. What is the amount of debt on Lowe's balance sheet as of February 3, 2017?

b. What proportion of Lowe's long-term debt is due before February 2, 2018?

c. How much of Lowe's assets were pledged as collateral as of February 3, 2017?

d. What effect, if any, does Lowe's collateral have on its credit risk and interest costs?

e. Assume that the notes due fiscal 2042-2046 outstanding at the beginning of the year were 4.26% notes issued to yield 4.4%. At the beginning of the year, these notes had an unamortized discount of $132 million. What cash interest payment did Lowe's make for these notes, assuming interest is paid annually? What interest expense did Lowe's record for these notes during the current year?

Correct Answer:

Verified

a. Total debt at February 3, 2017 was $1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: What determines the effective cost of debt?

Q29: Hamilton Company issues $5,250,000 in 7% bonds

Q30: Progressive Corp. (a property and casualty insurance

Q31: Progressive Corporation (a property and casualty insurance

Q32: Heller Company issues $950,000 of 10% bonds

Q34: Reed Corp. sells $700,000 of bonds to

Q35: Washington Inc. issued $675,000 of 6%, 20-year

Q36: EZ Wheels Corporation manufactures kick scooters. The

Q37: Credit ratings are an opinion of a

Q38: InterTech Corporation needed financing to build a