Short Answer

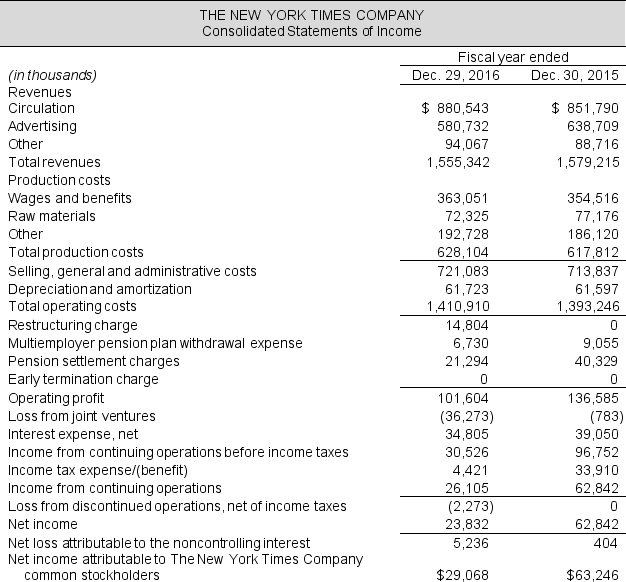

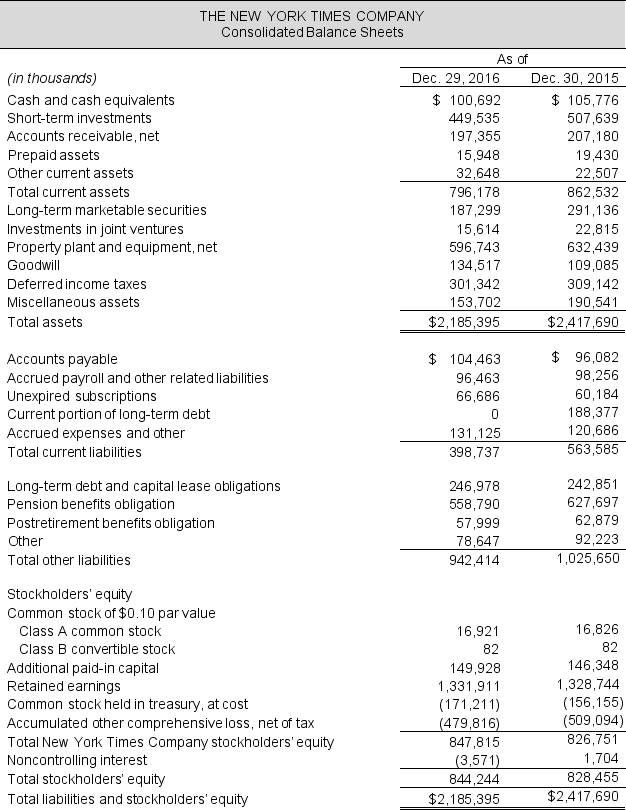

Income statements and balance sheets follow for The New York Times Company. Refer to these financial statements to answer the requirements.

Required:

a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rates are 37% for both years.

b. Compute net operating assets (NOA) for 2016 and 2015.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Comment on the year-over-year change. Net operating assets are $397,299 thousand in 2014.

d. Disaggregate RNOA into profitability and asset turnover components (NOPM and NOAT, respectively). What explains the year-over-year change in RNOA?

Correct Answer:

Verified

c. 2016: $48,032 / [($353,696 + $355,1...

c. 2016: $48,032 / [($353,696 + $355,1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: The fiscal 2016 financial statements for Walgreens

Q23: If Company A has a higher net

Q24: The 2016 balance sheet of Whole Foods

Q25: Liquidity refers to:<br>A) A company's operating cycle<br>B)

Q26: The 2016 balance sheet of The New

Q28: Mattel Inc.'s 2016 financial statements show operating

Q29: What is liquidity? Identify and discuss two

Q30: The fiscal year-end 2016 financial statements for

Q31: The fiscal 2016 balance sheet for Whole

Q32: Selected balance sheet and income statement data