Short Answer

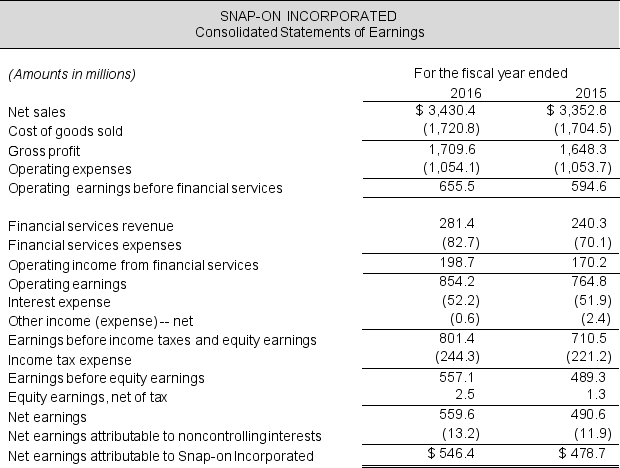

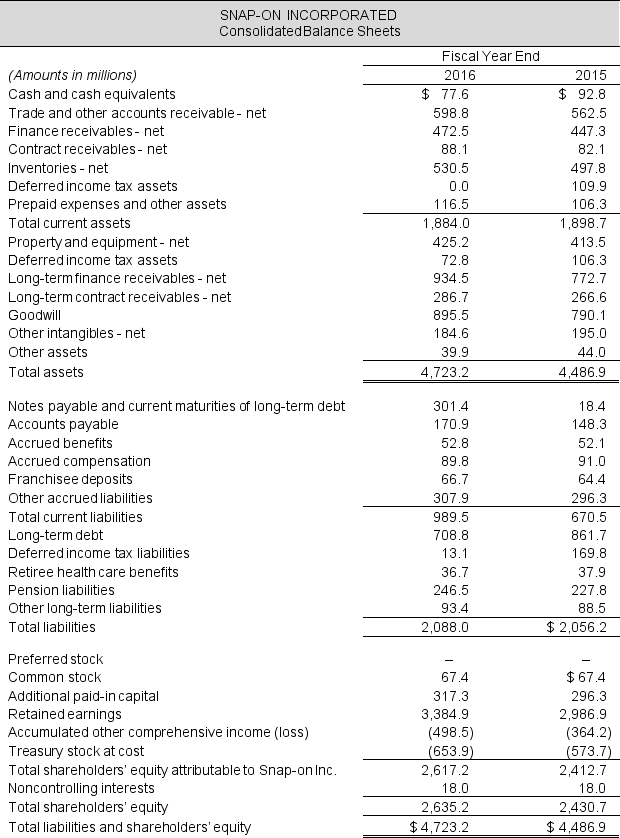

Income statements and balance sheets follow for Snap-On Incorporated. Refer to these financial statements to answer the requirements.

Required:

Required:

a. Compute the company's current ratio and quick ratio for fiscal 2016 and 2015. Comment on any observed trend.

b. Compute the company's times interest earned and liabilities-to-equity ratio for 2016 and 2015. Comment on any observed trend.

c. Summarize your findings in a conclusion about the company's liquidity and solvency. Do you have any concerns about the company's ability to meet its debt obligations?

Correct Answer:

Verified

a. Current ratio

2016: $1,884.0 / $989.5...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2016: $1,884.0 / $989.5...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: What is solvency? Identify and discuss two

Q57: Use the income statement for Microsoft Corporation

Q58: The 2016 financial statements of The New

Q59: Selected balance sheet and income statement data

Q60: Selected balance sheet data follow for Goodyear

Q61: ROE can be disaggregated into operating and

Q62: Repurchasing shares near year-end will increase a

Q63: Kroger's 2016 financial statements show net operating

Q64: The DuPont analysis disaggregates return on equity

Q66: The fiscal 2017 financial statements of Reed