Short Answer

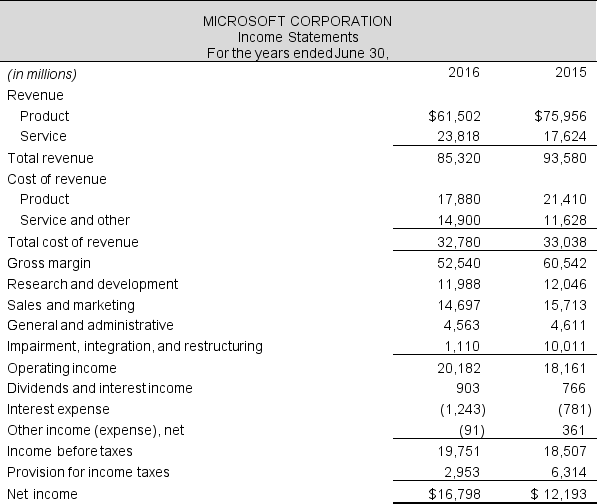

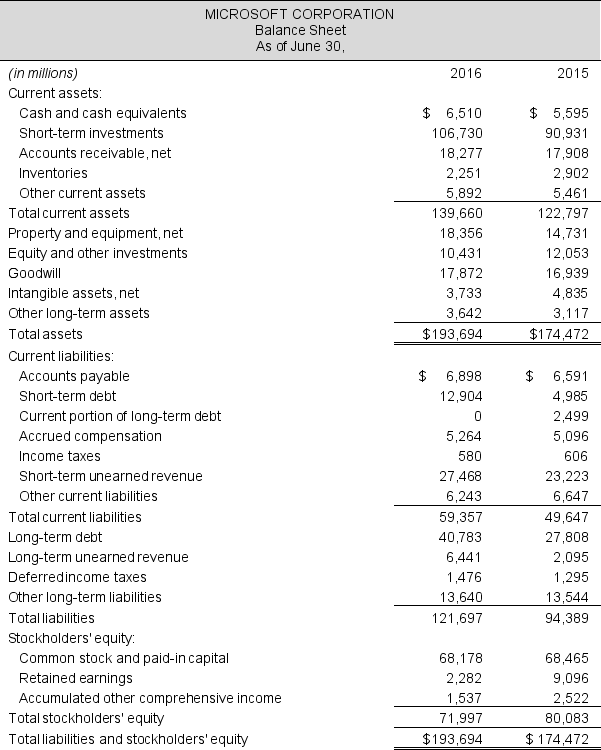

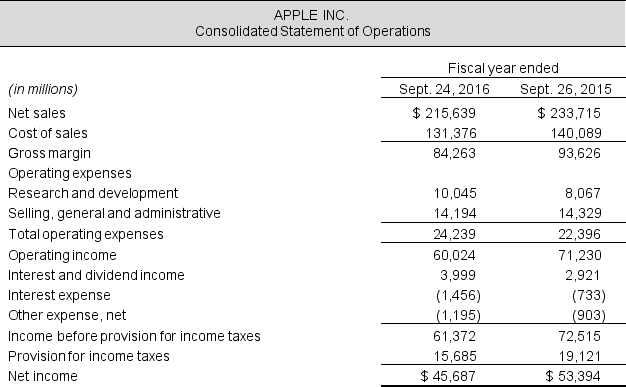

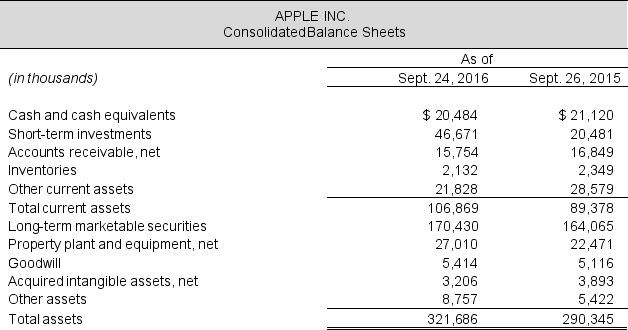

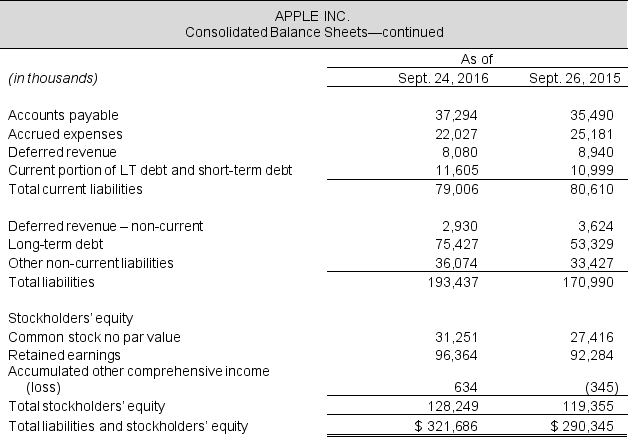

Income statements and balance sheets follow for Microsoft Corporation and Apple Inc. Refer to these financial statements to answer the requirements.

Required:

Required:

a. Compute the current ratio and quick ratio for both firms for fiscal 2016. Compare the ratios and determine which company is more liquid.

b. Compute the times interest earned and liabilities-to-equity ratios for both firms for fiscal 2016. Which company is more solvent?

c. Do you have any concerns about either company's ability to meet its debt obligations? Explain.

Correct Answer:

Verified

a. Current ratio

Microsoft: $139,660 / $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Microsoft: $139,660 / $...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: What is liquidity? Identify and discuss two

Q30: The fiscal year-end 2016 financial statements for

Q31: The fiscal 2016 balance sheet for Whole

Q32: Selected balance sheet and income statement data

Q33: Selected balance sheet and income statement data

Q35: Mattel Inc.'s 2016 financial statements show operating

Q36: The 2017 balance sheet of Staples, Inc.

Q37: Which of the following is a measure

Q38: To determine tax on net operating profit,

Q39: Selected income statement data follow for Harley