Short Answer

At the end of fiscal 2017, Nick's Greenhouse counted inventory and determined that inventories of $87,160 were on hand. The end of fiscal year the unadjusted inventory account balance is $95,000. Inventory at the start of the year was $99,880.

Which of the following accounting adjustments should Nick's Greenhouse record?

D) No accounting adjustment is required.

D) No accounting adjustment is required.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: How would a sale of $400 of

Q14: During fiscal 2016, Caleres Inc. (formerly Brown

Q15: During 2016, Nike Inc., reported net income

Q16: On January 1, Fey Properties collected $7,200

Q17: When shareholders contribute capital to a company,

Q19: Sales on account would produce what effect

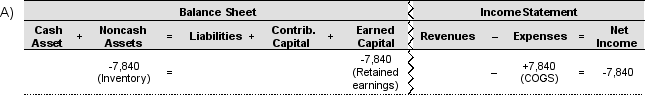

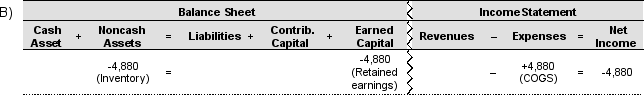

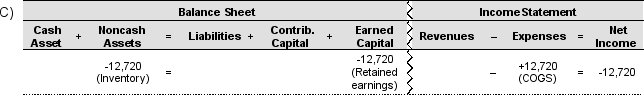

Q20: Examine the financial statements effects template below.

Q21: Record the following transactions in the financial

Q22: Companies make adjustments to more accurately reflect

Q23: Weimar World, a tax-preparation service, had