Short Answer

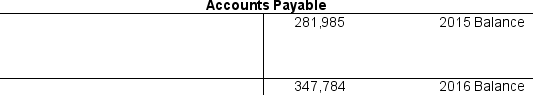

During the year ended December 31, 2016, Cabela's, Inc., a retailer of outdoor equipment and apparel, purchased merchandise inventory at a cost of $2,413,850 (in thousands). Assume that all inventory purchases were on account (on credit) and that accounts payable is only used for inventory purchases. The following T-account reflects information contained in the company's 2015 and 2016 balance sheets (in thousands).

Calculate the amount Cabela's paid in cash to its suppliers during 2016 and complete the T-account.

Correct Answer:

Verified

Payments on account =

Beginnin...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Beginnin...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: During fiscal 2016, Shoe Productions recorded inventory

Q49: Which of the following accounts would not

Q50: Record the following transactions in the financial

Q51: Expenses that are paid in advance are

Q52: Examine the financial statements effects template below.

Q54: During the year ended December 31, 2016,

Q55: The January 28, 2017 income statement and

Q56: Maibrit's Bike's began operations in April 2017

Q57: Revenues and expenses affect the income statement

Q58: Which of the following accounts would not