Short Answer

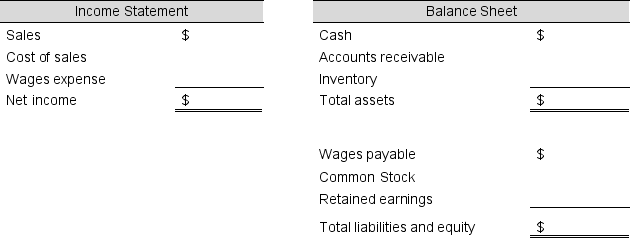

Craft Corner began operations in March with cash and common stock of $36,000. The company made $582,000 in net income its first month. It performed print jobs for customers and billed these customers $900,000. The company collected half of its receivables by the end of the month. The company had cost of goods sold of $162,000 paid for in cash and $6,000 inventory left over at the end of the month. Craft Corner employees earned wages but those are not paid until the first of April. This was the company's only liability.

Complete the following statements for the end of March.

Correct Answer:

Verified

Correct Answer:

Verified

Q39: How would a purchase $400 of inventory

Q40: Which of the following accounts would not

Q41: On January 1, Fey Properties paid $12,600

Q42: Graham Holdings Company (formerly The Washington Post

Q43: The 2016 income statement of The Coca-Cola

Q45: A company records an adjusting journal entry

Q46: Describe the closing process and explain why

Q47: You have been hired by Peters CAD,

Q48: During fiscal 2016, Shoe Productions recorded inventory

Q49: Which of the following accounts would not