Short Answer

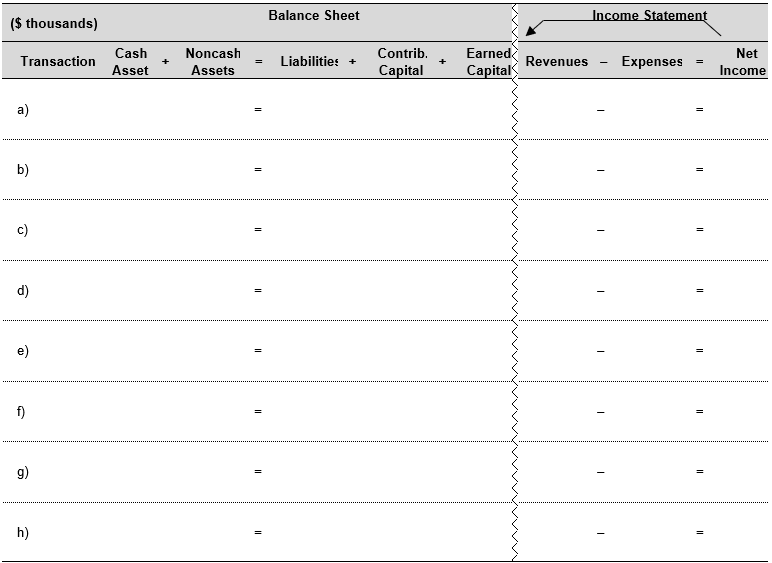

Record the following transactions for Mouser Pet Foods, Inc., in the financial statements effects template below (in thousands).

a) Sell stock in company for $78,000

b) Obtain long-term bank loan of $30,000.

c) Purchase manufacturing equipment for $20,400 cash.

d) Rent manufacturing and warehousing space and pay $34,800 in advance for the year.

e) Purchase $30,000 of inventory, paying $6,000 in cash and the remaining amount on credit.

f) Sell half of the inventory purchased in Transaction e for $33,900 on account.

g) Pay $24,000 to creditors.

h) Make loan payment of $4,800 of which interest is $480 and the rest is principal.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Explain what accounting adjustments are and why

Q8: During fiscal 2016, Shoe Productions recorded inventory

Q9: Revenue is typically recorded as earned when

Q10: The journal entry for recording cost of

Q11: During the month of March 2017,

Q13: How would a sale of $400 of

Q14: During fiscal 2016, Caleres Inc. (formerly Brown

Q15: During 2016, Nike Inc., reported net income

Q16: On January 1, Fey Properties collected $7,200

Q17: When shareholders contribute capital to a company,