Short Answer

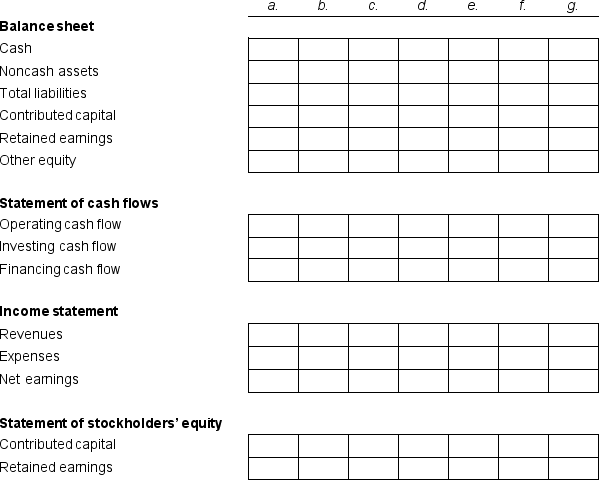

Consider the effects of the independent transactions, a through g, on a company's balance sheet, income statement, statement of cash flows, and statement of stockholders' equity.

a. The company issued stock in exchange for cash.

b. The company paid cash for rent.

c. The company performed services for clients and immediately received cash.

d. The company performed services for clients and sent a bill with payment due in 30 days.

e. The company compensated its employees with cash for wages.

f. The company received cash as payment on the amount owed from clients.

g. The company paid cash in dividends.

Complete the table below to explain the effects and financial statement linkages. Use "+" to indicate the account increases and "-" to indicate the account decreases.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Consider the transactions listed. Match them to

Q2: Prestige Company has determined the following information

Q3: All companies must file with the SEC

Q4: In 2016, Kohl's Corporation had net working

Q6: In its December 31, 2016 financial statements,

Q7: Use the accounts below for Stanley Black

Q8: Identify the financial statements in which you

Q9: The book value of stockholders' equity (the

Q10: The cash conversion cycle is computed as<br>A)

Q11: Identify which of the following items would