Multiple Choice

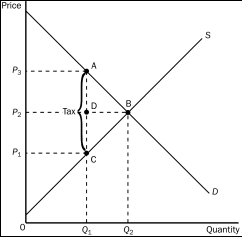

Figure 8-2

-Refer to Figure 8-2.The per-unit burden of the tax on sellers is

A) P₃ - P₁.

B) P₃ - P₂.

C) P₂ - P₁.

D) Q₂ - Q₁.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q29: The supply curve and the demand curve

Q31: Figure 8-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-4

Q33: Figure 8-2<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-2

Q35: When a good is taxed,<br>A)both buyers and

Q36: Which of the following scenarios is not

Q36: Scenario 8-1<br>Ryan would be willing to pay

Q39: A tax placed on buyers of tires

Q40: Taxes on labor encourage all of the

Q70: When a tax is levied on a

Q71: When a tax on a good is