Multiple Choice

Figure 8-6

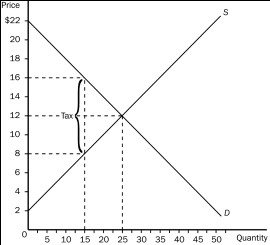

-Refer to Figure 8-6.Which of the following statements is correct?

A) The loss of producer surplus that is associated with some sellers dropping out of the market as a result of the tax is $30.

B) The loss of consumer surplus for those buyers of the good who continue to buy it after the tax is imposed is $60.

C) The loss of consumer surplus caused by this tax exceeds the loss of producer surplus caused by this tax.

D) This tax produces $200 in tax revenue for the government.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Taxes cause deadweight losses because they prevent

Q44: The deadweight loss from a tax<br>A)does not

Q54: Figure 8-2<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-2

Q57: The supply curve and the demand curve

Q61: Suppose a tax of $4 per unit

Q62: Figure 8-2<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-2

Q63: Oliver Wendell Holmes once said taxes<br>A)are the

Q64: Suppose the equilibrium quantity in the market

Q242: When a tax is levied on a

Q289: The Social Security tax is a tax