Multiple Choice

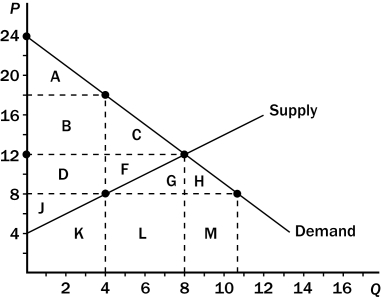

Figure 8-7 The graph below represents a $10 per unit tax on a good. On the graph, Q represents quantity and P represents price.

-Refer to Figure 8-7.One effect of the tax is to

A) reduce consumer surplus by $36.

B) reduce producer surplus by $24.

C) create a deadweight loss of $20.

D) All of the above are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Scenario 8-1<br>Ryan would be willing to pay

Q39: A tax placed on buyers of tires

Q40: Scenario 8-2<br>Tom mows Stephanie's lawn for $25.

Q40: Taxes on labor encourage all of the

Q42: For Henry George's single tax on land

Q43: Suppose a tax is imposed on the

Q44: Figure 8-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-5

Q46: For Henry George's land-tax argument to be

Q70: When a tax is levied on a

Q165: The most important tax in the U.S.