Multiple Choice

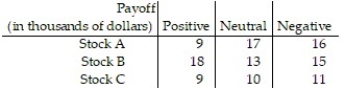

A person has hired an investment broker to buy stock. The broker has three different stock funds that are of interest, but each is sensitive to a certain economic indicator that is impossible to predict. The indicator will be positive, neutral, or negative. The table below shows the payoffs in thousands of dollars. Find the strategy that the broker should recommend to maximize the expected value of the investment.

A) Invest in Stock A with probability 1, invest in Stock B with probability 0, and invest in Stock C with probability 0.

B) Invest in Stock A with probability 5/13, invest in Stock B with probability 8/13, and invest in Stock C with probability 0.

C) Invest in Stock A with probability 4/13, invest in Stock B with probability 9/13, and invest in Stock C with probability 0.

D) Invest in Stock A with probability 0, invest in Stock B with probability 1, and invest in Stock C with probability 0.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Find the smallest integer k ≥ 0

Q2: Find the saddle values, if it exists,

Q3: In a two-finger Morra game, if player

Q4: A company has three different marketing strategies

Q5: Use the simplex method to find the

Q7: Find the expected value of the game

Q8: Determine which row(s) and column(s) of the

Q9: Is the following matrix game strictly determined?<br>

Q10: Solve the matrix game using a geometric

Q11: Find the saddle values, if it exists,