Multiple Choice

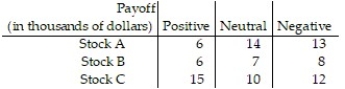

A person is considering three different stocks, and each is sensitive to a certain economic indicator. The indicator will be positive, neutral, or negative, and fluctuate randomly. The payoffs are given in the table below, in thousands of dollars. What investment strategy should the person make to obtain the best expected value of profit?

A) Invest in Stock A with probability 1/3, invest in Stock B with probability 1/3, and invest in Stock C with probability 1/3.

B) Invest in Stock A with probability 5/13, invest in Stock B with probability 0, and invest in Stock C with probability 8/13.

C) Invest in Stock A with probability 0, invest in Stock B with probability 1, and invest in Stock C with probability 0.

D) Invest in Stock A with probability 1, invest in Stock B with probability 0, and invest in Stock C with probability 0.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Delete recessive rows and columns from the

Q37: Two supermarkets, R and C, want to

Q38: Two Wally-Worlds are going to build within

Q39: Find the expected value of the game

Q40: Find the saddle point and value of

Q42: Find the smallest integer k ≥ 0

Q43: Find the saddle values, if it exists,

Q44: Find the value of the game.<br>-<img src="https://d2lvgg3v3hfg70.cloudfront.net/TB10044/.jpg"

Q45: Use the simplex method to find the

Q46: If M is a matrix game, then