Short Answer

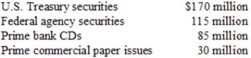

Stronghold Money Fund Assets is a relatively new money market fund with about $400 million in total financial assets and shares outstanding (each maintained at a value of $1.00 per share). Most of the fund's accounts represent the savings of high-income, interest-sensitive financial market investors. Stronghold's current distribution of financial assets currently is as follows:

Interest rates are expected to rise substantially in the money market over the next several weeks or months and Stronghold's management is concerned that its relatively low current yield (a seven-day average of 4.05 percent, one of the lowest yields among existing money funds) may result in the loss of many of its more interest-sensitive share accounts. The fund's average maturity is currently at 34 days, also substantially less than the industry's current average maturity of about 45 days. What steps would you recommend to help Stronghold Money Fund prepare for an apparent impending change in the money fund's condition?

Interest rates are expected to rise substantially in the money market over the next several weeks or months and Stronghold's management is concerned that its relatively low current yield (a seven-day average of 4.05 percent, one of the lowest yields among existing money funds) may result in the loss of many of its more interest-sensitive share accounts. The fund's average maturity is currently at 34 days, also substantially less than the industry's current average maturity of about 45 days. What steps would you recommend to help Stronghold Money Fund prepare for an apparent impending change in the money fund's condition?

Correct Answer:

Verified

In short, the expected interest rate hik...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q68: Credit unions are not permitted to make

Q69: A mutual savings and loan association, technically,

Q70: Due to their vulnerability to interest rate

Q71: The three leading consumer installment lending institutions

Q72: A growing number of savings and loans

Q74: Which of the following is (are) true

Q75: The U.S. government has authorized the agencies

Q76: Money market funds are insured by an

Q77: Most money market funds charge their customers

Q78: Why has the savings and loan industry