Short Answer

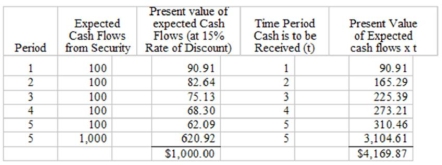

A government bond is scheduled to mature in 5 years. Its coupon rate is 10 percent, with interest paid to holders of record at the conclusion of each year. This $1,000 par value carries a current yield to maturity of 10 percent. What is its duration?

Correct Answer:

Verified

Duration =...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: The U.S. Treasury issues inflation-indexed bonds, known

Q34: According to recent research, real interest rates

Q35: According to the inflation-caused depreciation effect:<br>A) The

Q36: According to the expectations hypothesis, future changes

Q37: The elasticity of a debt security is

Q39: When the investor's desired holding period equals

Q40: The published or quoted rate of interest

Q41: The yield curve measures the rate of

Q42: The price elasticity of a security must

Q43: The size with the liquidity premium will