Short Answer

Each project will last an estimated 5 years with no remaining significant scrap value. Determine the IRR and the NPV for each of these two projects. What should INLAC decide about each proposed project, assuming the above figures are truly accurate?

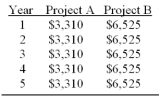

INLAC Company, Ltd. is examining two investment projects as a part of its expansion plan for the coming year. These two projects are not mutually exclusive. The cost of Project A is $9,870 while the second project (B) is expected to cost $17,850. INLAC's cost of capital (required rate of return) is 12 %. Expected annual cash flows are projected to be as follows:

Correct Answer:

Verified

Again using a financial calculator, Proj...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q53: Money demanded for transactions and precautionary purposes

Q54: Dishoarding of money leads to higher interest

Q55: Suppose the total demand for money is

Q56: According to the Liquidity Preference theory of

Q57: As long as projects are mutually exclusive,

Q59: A new drill press is considered a

Q60: Factors influencing the investment decision-making process of

Q61: What are the functions or roles played

Q62: Explain how the equilibrium loanable funds interest

Q63: When U.S. interest rates rise relative to